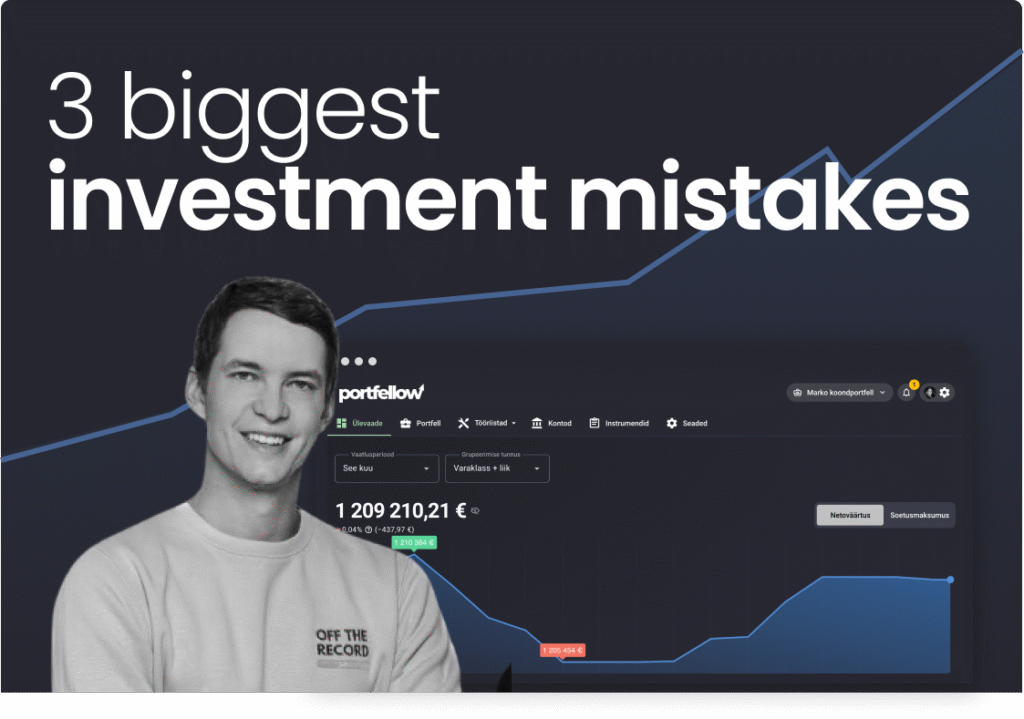

Making mistakes is an inevitable part of any investment journey. The positive side of mistakes is the opportunity to learn from them and expand one’s experience. The negative side usually means losing money. But not only that – along with the money, the time spent earning the initial capital and the time it will take to recover the losses also go to waste.

How costly investment mistakes turn out to be depends on how quickly we learn from them. That’s why I want to honestly share some of the biggest missteps and lessons from my own investing career.

A wise person learns from others’ mistakes. Learn from mine. Not everything needs to be experienced first-hand.

Mistake #1 – Biting off more than I could chew

At the beginning of my investment journey, I decided to invest in a newly launched hedge fund that operated with high-risk trading strategies. The founder had an impressive background, and other reputable investors were also on board. I decided to invest €5,000 – the fund’s minimum entry – which at the time made up about 18% of my entire portfolio.

Fast forward 8 years: the investment is now worth about €100, meaning only 2% of the original investment remains. The estimated loss is around €4,900, which translates to a -40% annualized return (XIRR method).

So what went wrong?

In my view, the mistake wasn’t choosing the fund. It was a high-risk fund from the start, and the possibility of losing all your money was communicated clearly. Of course, no one invests expecting a total loss, but the risks were known.

The real mistake was in risk management. This investment represented too large a share of my portfolio. Losing this one investment significantly affected my total portfolio value.

Lesson: Poor risk management

This experience taught me the importance of proper risk control. Today, I’ve set strict percentage limits on how much of my portfolio can be allocated to a single investment. Generally, the limit is 2.5%, and for lower-risk investments with a strong thesis, up to 5%. With this kind of risk management, the loss of any one investment won’t meaningfully affect the overall portfolio.

Depending solely on your salary is one of the biggest financial risks you can take. The moment you lose that job, your cash flow vanishes. Multiple income streams—dividends, rental income, interest, business profits—give you resilience and freedom.

Tip: Your portfolio shouldn’t just grow; it should pay you.

Mistake #2 – Betting on others’ skin in the game

In 2015, an early-stage fintech company launched. One of the three founders was someone I knew, and several well-known individuals were part of its founding team (read: board members). Wanting to invest like other reputable investors, I put in €5,000.

Two years later, an audit revealed that two of the founders had made illegal transactions with company funds. The entire board and management team were replaced. Today, the investment is worth about €1,800, resulting in an estimated loss of €3,200.

So what went wrong?

At the time of investing, I had only met one of the three founders. Caught up in the excitement, I didn’t research the other founders’ financial commitment to the company. After the bad news came out, the board quickly resigned, and it turned out that only a few had financially committed to the project themselves.

The mistake was not doing enough due diligence. I didn’t meet all the founders. I relied too heavily on the presence of high-profile investors without verifying their actual involvement or motivation.

Lesson: Do your research

With early-stage startups, it’s crucial to meet the entire founding team. Ideas are only as strong as the people behind them, so your thesis should be built on your belief in the team.

Every investment decision should be based on your own research – not others’. Every investor has a unique journey and background, so copying others blindly isn’t wise.

Mistake #3 – Trading out of boredom

In the fall of 2021, I had some free time and excess cash. I thought, “Why not do some trading to beat the boredom?”

I chose Bitcoin and put in the first €1,000. After the price dropped, I panicked and sold. Then the market turned upward – and I felt like selling had been a mistake, so I reinvested the €1,000. But the market dipped again, and I panicked again – sold.

A while later, the market made a major drop. I figured it was a great buying opportunity and entered three consecutive €1,000 positions. As the market kept falling, I added more, trying to average down – five more times.

Eventually, after a steep 21% drop over three days, fear overtook me. I realized the market could remain irrational longer than I could stay solvent. So I exited my full position. Naturally, the market bounced right after – and so did I, jumping back in “near the bottom.”

My total investment: €9,476. Final value: €4,350. Estimated loss: €5,127, or -40% annualized return (XIRR).

So what went wrong?

There was no investment thesis, and no strategy. Everything was emotion-driven. I had no framework for decision-making.

Fortunately, risk management saved me. The total bet was less than 1% of my overall portfolio, and the loss was only 0.5% of total value – so the impact was negligible. But that doesn’t justify poor decision-making.

Lesson: Don’t trade out of boredom

I learned that any investment must be guided by a clear thesis and strategy. I also need to understand whether I have a competitive edge in that asset class. In public markets, I have no edge – no better information, experience, or time than professional teams.

So should I expect to outperform? Probably not. Lesson learned: don’t trade as a hobby.

Reinforcing the Lessons

I don’t count the mistakes where I lost the most money as my worst investing mistakes. To me, the worst mistakes are bad decisions made without a thoughtful strategy.

To learn from mistakes, we need to face the data. Writing down and analyzing poor decisions gives us the chance to extract lessons we can use in the future.

Burying your head in the sand and refusing to admit losses won’t make you a better investor. Sharing mistakes with others is a great way to reinforce the lessons. On one hand, it forces introspection; on the other, it creates a public commitment not to repeat them.

And as a bonus – readers will now naturally hold me accountable. So here I am, quietly responsible in front of all of you.